We are proud of the tools and information we provide and unlike some other comparison sites, we also include the option to search all the products in our database, regardless of whether we have a commercial relationship with the providers of those products or not. You do not pay any extra for using our service. As a marketplace business, we do earn money from advertising and this page features products with Go To Site links and/or other paid links where the provider pays us a fee if you go to their site from ours, or you take out a product with them.

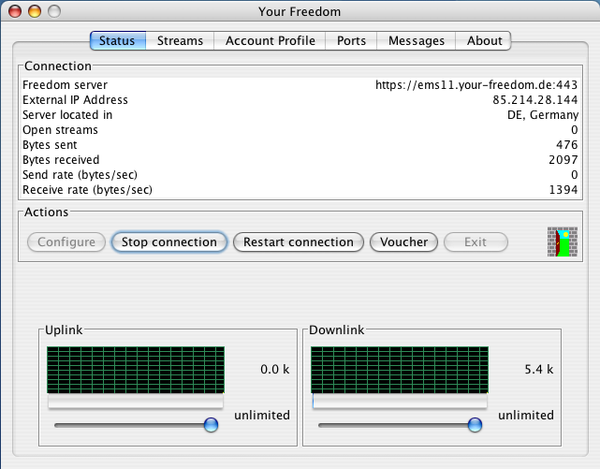

YOUR FREEDOM ACCOUNTS FREE

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. If you’re in the market for a travel friendly bank account, compare deals in our travel debit card section.Īlso keep in mind, the bank account pays no interest so it’s best to keep the bulk of your funds in a linked high interest savings account and transfer across.ĭisclaimer Who we are and how we get paid It comes with a 3.00% currency conversion commission, as well as a $5 overseas ATM withdrawal fee at any ATM outside the Global ATM Alliance, which could quickly take a chunk out of those travel savings, if used frequently. What's more, if you're a new customer, you could receive a $40 cashback if you apply for a Complete Freedom Account by 29 March 2023, deposit $500 and make 5 transactions within 30 days of opening the account.Īs with many standard bank accounts, the BankSA Complete Freedom Account isn’t specifically designed for overseas spending.

In addition BankSA Secure guards both your information and finances with rigorous security measures, such as encryption technology. There’s no need to worry about security either, as the bank account comes with BankSA Fraud Money Back Guarantee.

If you love the convenience of paying with your smartphone, you'll be pleased to know the BankSA Complete Freedom Account is also compatible with multiple contactless payment options including Apple Pay, Google Pay, PayID and Samsung Pay.

YOUR FREEDOM ACCOUNTS PLUS

Plus you’ll be able to make “tap and go” purchases in Australia, thanks to Visa payWave functionality. The bank account comes with a Visa Debit Card, which means you can shop anywhere Visa is accepted around the world. Plus, this account does not charge a monthly account keeping fee, so that's one less fee to worry about! You can also access your cash through phone and internet banking, in branch or via EFTPOS.

YOUR FREEDOM ACCOUNTS HOW TO

Here's how to get your student off on the right foot. This rite of passage should take place during your child's high school years. Now give them the tools to manage their money!īefore you send your child to live on his/her own at college, it's a good idea that he/she establishes a checking account and learns how to use it correctly. You taught them the basics Wash, Cook, Clean.

0 kommentar(er)

0 kommentar(er)